- #Payroll quickbooks tutorial full#

- #Payroll quickbooks tutorial pro#

- #Payroll quickbooks tutorial software#

List of Few Common Payroll Errors in QuickBooksĪlthough QuickBooks gratify you with numerous advantageous features but it does withhold some technical hiccups. With us, you will always enjoy the best experience as our team contains certified accountants, CPA’s, and ProAdvisors who are highly efficient at their work. If you are starting QuickBooks Payroll from scratch, you’ll select No, I’m a brand new employer paying T4 employees for the first time. If you have, you’ll select the option Yes, I’ve already paid T4 employees this year.

#Payroll quickbooks tutorial pro#

We, at Pro Accountant Advisor take care of your entire queries and problems related to QuickBooks Payroll. QuickBooks needs to know if you’ve paid employees before using QuickBooks Online Payroll.

But definitely, it’s not the best way out to receive immediate support.!

#Payroll quickbooks tutorial full#

You can view the full range of QuickBooks courses that Simon Sez IT offers by going here. To get the remainder of the course you’ve just watched, you can become a full, Simon Sez IT member for only 25/month. In such a circumstance, you can refer to the Intuit Payroll Support Page to know the answer or raise a query. This free course is taken from the full Simon Sez IT QuickBooks 2020 course. It’s so unfortunate that you will hardly find any way to contact any Intuit support executive or agent directly. You can either sort out Payroll error by contacting Intuit or get in touch with our payroll customer service team. But woefully, sometimes the QuickBooks Payroll users encounter critical errors while handling it. payroll, tax filing, invoicing, bank account tracking and reconciliation. While we normally recommend that a business owner outsource the payroll function to a third party vendor, many choose to keep the payroll function in-house.

#Payroll quickbooks tutorial software#

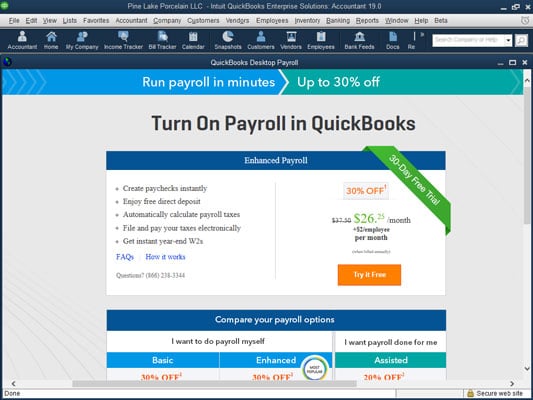

This software ensures that every employee in the organization attains exact figures, insurances, and allowances. QuickBooks and Quicken are two of the most widely used financial management. QuickBooks Payroll, no matter what version your company is using or considering using, is extremely sophisticated software that is user friendly. Most of the business owners, accountants, bookkeepers, and CPA’s use the Intuit QuickBooks Payroll services for the exact tax and payroll calculation. Click Step (2) Click here to Import the list of employees into Payroll Mate. Read the Information provided regarding importing. Select the QuickBooks CSV file you created. Management of Payroll guarantees you that your time will save by providing timely preparation of your W-2’s at the end of the year and by eliminating time spent balancing and cross-checking for errors. Click Step (1) Click here to Load a generic CSV file.

Within this post, you can get details about QuickBooks Payroll setup checklist: Desktop/Online/Intuit Payroll. It doesn’t matter you are a one-person company or you have several hundred, time is valuable. Payroll feature is important in QuickBooks. Payroll Management has been serving the payroll needs since many decades ago or since 1989. There is an alternate way to do business, by outsourcing non-core functions like Payroll. You can obtain success around the globe with greater time demands and leaner profit margins. Payroll Software & Services for Small Business

0 kommentar(er)

0 kommentar(er)